The Nigerian manufacturing sector is facing existential crisis. Between 2015 and 2023, the sector has lost more than 200 factories, according to Dataphyte investigations.

More than 300 manufacturers have delisted as members of the Manufacturers Association of Nigeria (MAN) within this period, accentuating the low attractiveness of the sector. Some of the manufacturers divested to other sectors such as oil, gas and agriculture, while others either exited the Nigerian market or stopped production.

P&G, Louis Carter, GSK, others

The list of the companies that have either shut down or delisted as members of MAN is long. In 2014, Procter and Gamble (P&G) set up a $300 million diaper plant at Agbara, Ogun State, to the excitement of Nigerians. It was celebrated by many, as it was the biggest United States’ non-oil investment in the country at that time. However, stories upon stories crept in and the company stopped production in 2018.

The firm released a press statement after the closure, noting that it was restructuring its operations in order to be more efficient. “P&G is restructuring its Nigeria manufacturing operations to deliver a more effective business operation for now and sustainably for the future,” a statement signed by Lola Adenuga of the company’s communications department had said.

However, findings showed the company was hard hit by high import duties, constant demand of bribes by Customs officials, and multiplicity of taxes at Agbara at that time. The Nigeria Customs Service (NCS) did not deny this allegation at that time. P&G building is still at Agbara, but it is now a trading hub for its Ibadan plant and imported products.

In 2017, a company known as Kenfrancis Farms was formed to produce and process agricultural products for export. However, this was not to be as dollar crunch and high production cost chased it out of business.

Chief Executive Officer of the company, Mr Francis Okeleke, told Dataphyte that the Anambra State-based firm shut down in 2019 and had divested to services.

“We thought that it was an opportunity for us to invest in the productive part of the economy, but we could not cope with inflation, dollar scarcity and high production costs. We needed to import raw materials but we could not because there were no dollars,” he added.

Similarly, Louis Carter, a popular plastics maker based in Nnewi, Anambra State, shut down in 2017 due to high energy costs. The company had been in operation since 1989, but had to shut down when it was no more sustainable to produce.

“We had issues with power supply. We were frustrated by the Enugu Electricity Distribution Company,” former General Manager of Louis Carter Industries, Mr Ndubuisi Okoli, told this newspaper.

More so, Nigerians woke up to the news of GlaxoSmithKline (GSK)’s exit on August 8, 2023. GSK used to import drugs from its UK manufacturing plant until a few years ago when it decided to use third parties such as Fidson to produce drugs in the country. However, its recent announcement meant that the use of third parties was no longer an option.

“In our published Q2 results we disclosed that the GSK UK Group has informed GlaxoSmithKline Consumer Nigeria PLC of its strategic intent to cease commercialisation of its prescription medicines and vaccines in Nigeria through the GSK local operating companies and transition to a third-party direct distribution model for its pharmaceutical products,” the company said.

“For the above reasons, and having, together with GSK UK, evaluated various other options, the board of GlaxoSmithKline Consumer Nigeria Plc has concluded that there is no alternative but to cease operations.”

In spite of these reasons, those familiar with the company attributed the decision to exit to the unsustainability of the use of local operating firms due to high production costs in the economy.

Moak, Georgeous, others

Kaduna-based Gorgeous Metals shut down in 2018 owing to policy flipflops. Managing Director of the company, Mr Murphy Ugwu, told Dataphyte that foreign exchange policies and government’s inability to honour its contracts were responsible for the shutdown.

“It was no longer possible to continue after all these,” he noted.

Benin-based nylon maker, Aenold, shut down in 2016 owing to what it described as “high input costs.”

“The problem was that the cost of raw materials rose by more than 50 percent one year after President Buhari came to power. Most of the raw materials are imported, so his foreign exchange policies did not favour us,” Executive Director of the now moribund company, Ms Sandra Agbase, told Dataphyte.

Steel makers have blamed the former Finance Minister, Ms Zainab Ahmed, for contradictory import duties which hurt the sector so badly. They say the former minister approved scrap metals for export, which was a critical input for steel.

However, Special Adviser to former Finance Minister on Media and Communications, Mr Yunusa Tanko Abdullahi, denied the allegation, saying that “the Hon Minister is not the Minister of Trade and Industry so how could she do that?”

A spokesman for the former Minister of Industry, Trade and Investment, Mr Ifedayo Sayo, also denied culpability, saying that he was not aware that the minister ever approved scrap metals for export.

The issues: Raw materials, energy

Nigerian manufacturers import some of their raw materials. Dollar crunch, which started in 2014, has forced them to look more inwardly, but this has also exposed that some of the locally available inputs are either insufficient or not in the required quality.

A typical example is gypsum, a major input used in cement, glass and ceramics production. The commodity sometimes falls below the required quality, forcing cement makers such as Dangote Cement, BUA and Lafarge to look outwards.

Professor of Ceramics Engineering, Patrick Oaikhinan, told Dataphyte much money was required to develop local raw materials.

“Some of them are still at their raw state and will require beneficiation or processing. We need investors at this leg of the economy to support manufacturers,” he noted.

Scarcity of foreign exchange has hit several industries hard in the last eight years, leading to shutdown of some and recalibration of others. Today, the dollar is severely scarce, even with the current floating of the foreign exchange market. The dollar hit N945/$ at the close of the parallel market on August 9, but the gap was over N150 when compared with the NAFEX market rate, thereby encouraging arbitrage.

Manufacturers have however managed to source inputs locally (what is sometimes referred to as backward integration). In 2014, local input sourcing was 47 percent. This rose to 63.2 percent in 2017 but declined to 57.45 percent in 2020 and further to 52.8 percent in 2022, according to data from the Manufacturers Association of Nigeria (MAN).

Energy spend

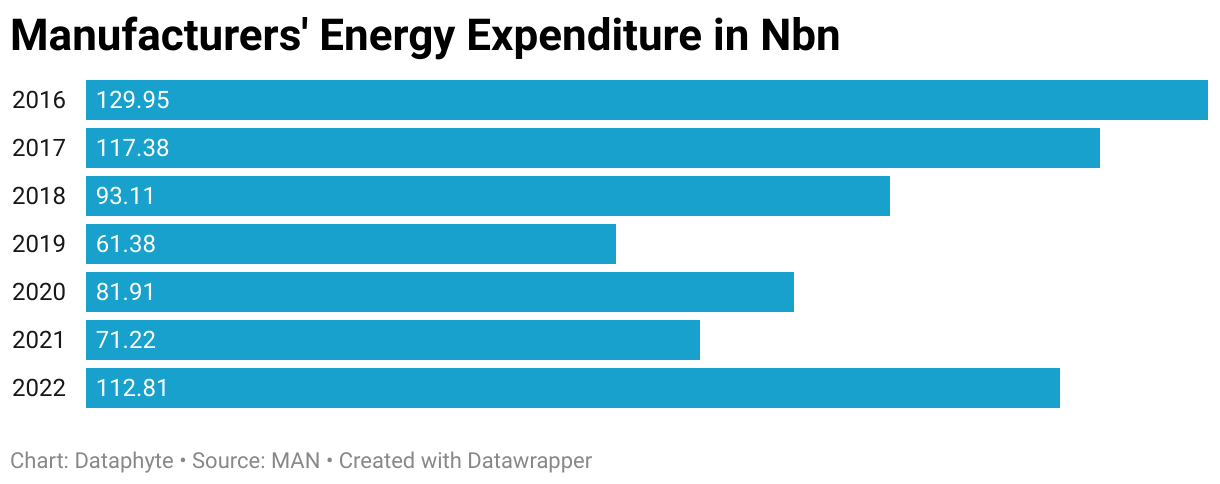

Power is an essential input in manufacturing, gulping 30-40 percent of firms’ expenditure, according to MAN. Manufacturers’ energy spend has increased from N58.82 billion in 2015 to N112.81 billion in 2022.

“The poor power supply from the grid fueled self-energy generation among manufacturers as expenditure on alternative energy source soared to N67.77 billion in the first half of 2022 (year-on-year) up from N32.18 billion recorded in the first half of 2021 and N45.04 billion of the second half respectively,” MAN said.

MAN says that manufacturers self-generate 13,000 megawatts of power due to poor power supply from electricity distribution companies, with huge cost implications. Cost of petrol has risen by over 200 percent since the removal of fuel subsidies in late May 2023, and manufacturers are complaining the effect of that on production costs. Diesel prices have also been trending upwards.

“The Manufacturers Association of Nigeria is greatly concerned about the implications of the over 200%

increase in the price of AGO on the Nigerian economy and the manufacturing sector. This will lead to reverse-multiplier effect, as cost of production escalates while the headways already made in the sector are grossly eroded,” Director-General of MAN, Mr. Segun Ajayi-Kadir, said.

He noted that the rising price of diesel was shutting down a number of manufacturing plants in the country, stressing that diesel price had doubled in the last two years.

Interest rate hike

Rising inflation has driven the monetary policy rate -benchmark interest rate – from 11.5 percent in May 2022 to 18.5 percent in May 2023, hurting manufacturers in need of funding for expansion. Constant raising of interest rates by the Central Bank of Nigeria (CBN) has, however, not halted inflation as expected. Inflation hit an 18-year high of 22.8 percent in July 2023 from 15.92 percent in March 2022.

Chief Executive Officer, the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) should address the supply side of the economy, rather than raise interest rates, in order to fix inflation.

Other issues

In addition to energy and foreign exchange crisis, delay of raw materials and finished goods at the ports, poor road network and policy inconsistencies are also hurting manufacturers.

Products meant for export stay at Apapa and Tin Can ports for weeks, with raw materials constantly being delayed due to lack of scanners for container inspection at the ports. The Nigerian Ports Authority and the Nigeria Customs Service still do manual inspections of containers, thereby frustrating manufacturers and exporters.

More so, policies are changed at will, an example being the 2014 automotive policy which was reversed by the Muhammadu Buhari administration in 2019.

Poor patronage due to the consumer shrinking wallets in the country is also a major issue, with multidimensional poverty standing at 63 percent. Many families cannot afford a number of things, including locally-manufactured products, as rising inflation eats into their incomes.

Way forward

The Director-General of Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said Nigeria should have an energy policy to reduce manufacturers’ production costs. He urged the government to support manufacturers to be competitive in both local and global markets, citing provision of low-cost funding, infrastructure and solutions to Apapa ports crisis as the way forward.

He also called for the proper concession of Ajaokuta Steel Complex, noting that a lot of local raw materials could be obtained from it when revamped.

“We can unbundle Ajaokuta Steel before concession. We can get the private sector involved, that is, a company with the technical and financial capabilities to manage it. Doing that will help manufacturers and the economy at large. I once worked there and we should not allow that massive plant to die,” he added.

For Ajayi-Kadir, the government should remove value-added tax (VAT) on diesel “as instant stimulus for immediate reduction in price and expedite action in reactivating or privatizing the petroleum products refineries in the country.”

He urged President Bola Tinubu to direct all relevant agencies of government to ensure that the electronic call-up system

at ports, which was aimed at redressing the congestion, worked without fail.

“It is also important to direct the NERC to admit all qualified applicant companies into the Eligible Customer

Scheme in order to allow them access to power as stipulated in the Electric Power

Sector Reform Act 2005,” he noted.

“Announce a special policy initiative to address the revival of closed and distressed industries, particularly in the northeast where 60% of our member companies have closed,” he added.

Comments 1